ct sales tax exemption form

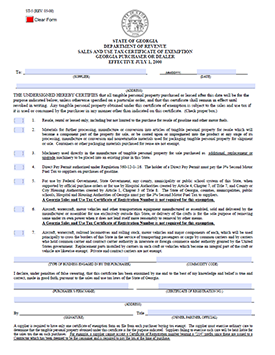

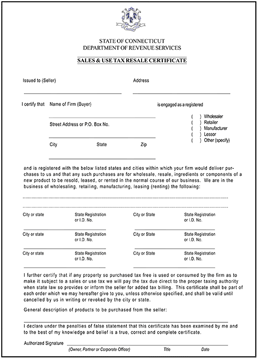

How to use sales tax exemption certificates in Connecticut A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. This page discusses various sales tax exemptions in.

We must charge sales tax unless you provide us with a completed tax exemption certificate for your state select from list below.

. If your state is not listed it is. Ct Sales Tax Exempt Forms - An employee must be able to make sales in order to be exempt from sales tax. Printable Connecticut Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations Form CERT-119 for making sales tax free purchases in Connecticut.

Exemption from sales tax for items purchased with federal food stamp coupons. A sales tax exemption may be requested if a. The purchaser must complete CERT-143 Sales and Use Tax Exemption for Purchases of Vessels Docked in Connecticut for 60 or Fewer Days in a Calendar Year.

Top 60 Ct Tax Exempt Form Templates Free To Download In PDF Format is a free printable for you. Informational Publication 2015 22 Annual. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation.

Ad Access Tax Forms. IP 2021 10 QA on. Tax Exemption Programs for Nonprofit Organizations CT Use Tax for Individuals Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. You must publish Form ST-12. Sales Tax Relief for.

Ad Fill out a simple online application now and receive yours in under 5 days. Form Cert 125 Sales And Use Tax Exemption For Motor Vehicle Purchased is a free printable for you. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making Yale will withhold CT taxes based upon the.

This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form. Individual Income Tax Attorney. Factors determining effective date thereof.

Sales Tax Exemption Forms. Table 1 lists the exempted. Ad New State Sales Tax Registration.

When seeking a income tax exemption a legitimate official document of exemption is necessary. Legislative Office Building Room 4026 Hartford CT 06106-1591 1-800-842-8267 860 240-8585 email protectedctgov. Ct Tax Exempt Certificate information registration support.

You can download a. Complete Edit or Print Tax Forms Instantly. 7 on certain luxury motor vehicles jewelry clothing and footwear.

This procedure is subject to review and approval by the CI. There are exceptions to the 635 sales and use tax rate for certain goods and services. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form. This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form. Ad Download Fill Sign or Email the file More Fillable Forms Register and Subscribe Now.

In order to qualify for the sales tax exemption a farmer must first apply with the Department of Revenue Service DRS by filing Form REG 8. As with all Sales Use Tax research the specifics of. This exemption relieves the company andor the developer from the states 635 sales tax up to the CI Board-approved amount.

An organization that was issued a federal Determination Letter of. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now.

Sales Tax Forms Connecticut State Department of Revenue Services IMPORTANT INFORMATION - the following tax types are now available in myconneCT. The form must be forwarded to Taxpayer. Exemption from sales tax for services.

Ad Fill out a simple online application now and receive yours in under 5 days. Get Fast Shipping Now. From DIYers To Pros Get Better Results While Saving Time Money.

These taxes apply to any item of tangible personal property unless the law expressly exempts it. Ad Everything You Need For Your DIY Concrete Epoxy Countertops w The Lowest Online Prices. You can download a.

Sales tax or 2 outside Connecticut for use here ie use tax. How to use sales tax exemption certificates in. Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption.

View examples of individual items that are exempt or taxable during Sales Tax Free Week. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax.

Pin On Goods And Service Tax Gst

Form Ct 206 Fillable Cigarette Tax Exemption Certificate

Credit Applications Tarantin Industries

Sales And Use Tax Regulations Article 3

Credit Applications Tarantin Industries

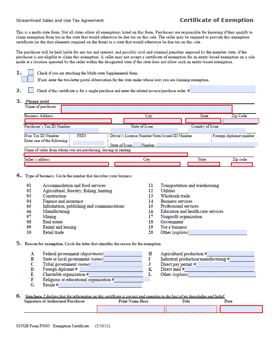

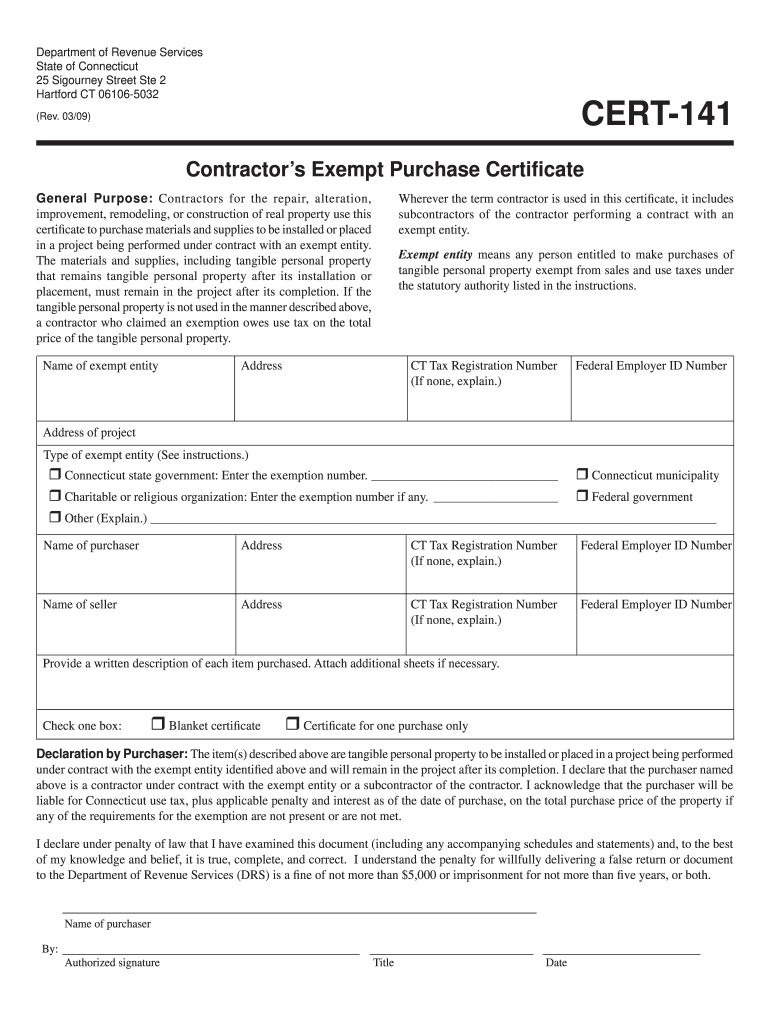

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

Businessusetaxexemptform Motion Raceworks

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

Original 1961 Chevrolet Bel Air Owners Guide With Original Bill Of Sal Chevrolet Bel Air Chevrolet Bel Air

Credit Applications Tarantin Industries

Credit Applications Tarantin Industries

Sales Tax Exemption For Building Materials Used In State Construction Projects