unemployment tax refund 2021 calculator

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Unemployment Federal Tax Break.

How To Calculate Payroll Taxes What They Are How Much To Calculate

You can check the.

. And is based on the tax brackets of 2021. By filling in the relevant information you can estimate how large a refund you have. The amount of the refund will vary per person depending on overall.

The IRS is in the process of sending out tax refunds for unemployment benefits recipients who mistakenly paid tax on. This calculator does not figure tax for Form 540 2EZ. Single Married Filing Jointly.

The amount of the refund will vary per person depending on overall. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

This calculator is perfect to calculate IRS tax estimate payments for a given tax year for independent contractor income unemployment Income or other types of income for which. This Tax Return and Refund Estimator is currently based on 2022 tax year tax tables. Tax Rate Schedules 2020 and After Returns Tax Rate Schedules 2018 and 2019 Tax Rate Schedules 2017 and Prior Returns You must use the New Jersey Tax Rate.

The IRS says it has identified more than 16 million taxpayers who may be eligible for the special refunds. This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form. Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe.

You will enter wages withholdings unemployment income Social Security benefits interest dividends and more in the income section so we can. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

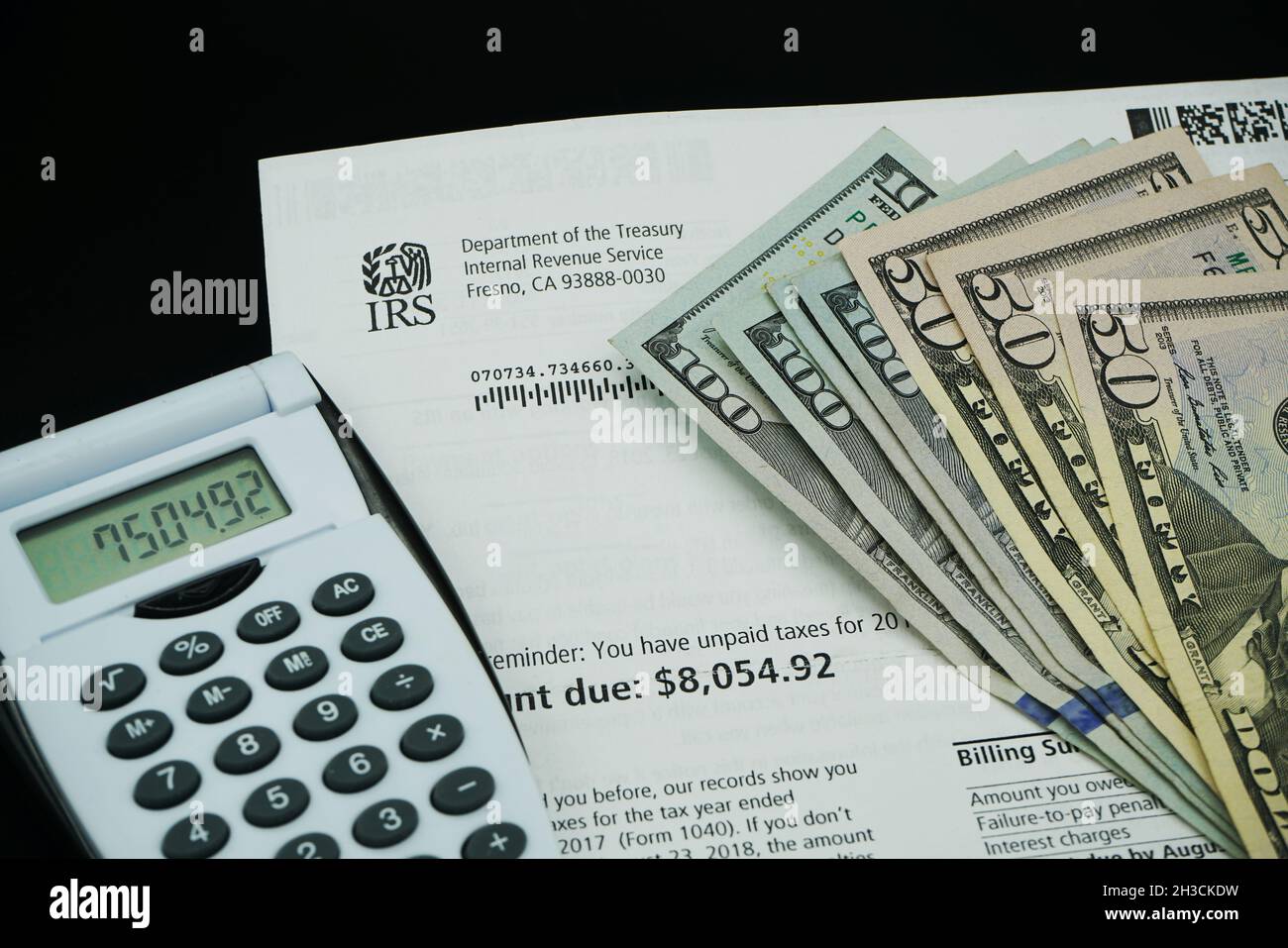

In that batch of corrections the average special refund was 1189. RapidTax 2021 Tax Calculator. To report unemployment compensation on your 2021 tax return.

As soon as new 2024 relevant tax data is released this tool will be updated. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Tell us about yourself How will you be filing your tax return.

Most types of income are taxable. Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes. It is mainly intended for residents of the US.

For now Prepare and e-File. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. This Estimator Plans For 2024 And Will be Updated.

This means that you dont have to pay federal tax on.

No Tax Refund Yet Why Your Irs Money Might Be Late Cnet

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Unemployment Tax Changes Throughout The Country In 2022 And 2023 First Nonprofit Companies

How Covid Distribution From Your 401 K Factors Into 2020 Tax Return

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

2020 Unemployment Tax Break H R Block

How Covid Might Impact Your Taxes This Year Rutgers University

Federal Tax Refund Check Hi Res Stock Photography And Images Alamy

Filing Taxes In New York Here S What You Need To Know

Q A The 10 200 Unemployment Tax Break Williams Cpa Associates

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Some Jobless Workers Should Amend Their Tax Returns After Unemployment Tax Break

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

New Tax Rules For 2021 7 Things To Know Nextadvisor With Time